Commentary by Oscar Gutierrez

Municipal financing is complicated and difficult to understand to the average taxpayer and, as a result, often ignored and misunderstood. However, there are direct correlations between municipal financing, bond rating and cost to taxpayers which make it extremely important to both the local government entity and its residents.

Basically, local governments and school districts issue municipal bonds for development projects, such as road projects, new schools, construction projects and community enhancements. These can be described as “loans” investors make to fund projects. Interest paid on these bonds is often tax free, which is a huge benefit to local schools and governments.

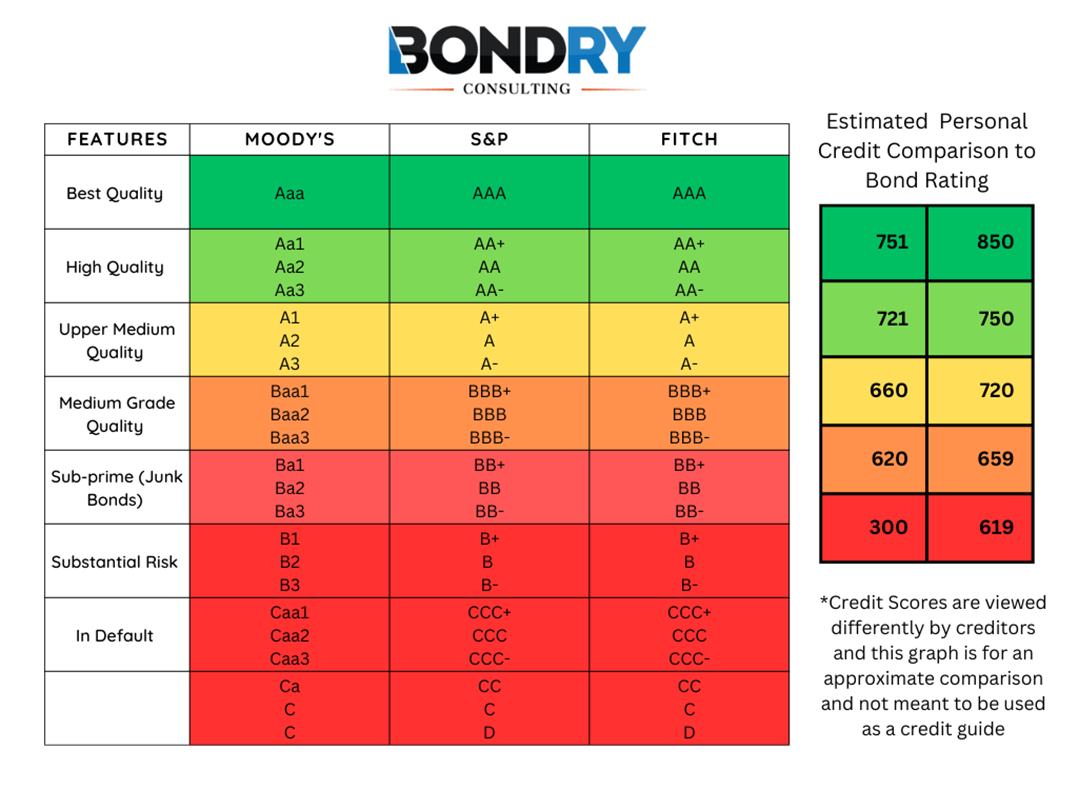

The amount of interest paid on bonds is based on a municipal bond rating. In simple terms, a municipal bond rating measures the creditworthiness of a bond, which ultimately impacts the overall cost of borrowing for the municipality. Understanding municipal bond ratings is very similar to your individual credit score. If you have a car loan, mortgage or credit cards, you are familiar or have at least seen your credit report at one time or another. Personal credit scores are rated primarily by three agencies – Equifax, Experian and TransUnion. Bond ratings also have three primary rating agencies – Standard and Poor’s (S&P), Moody’s and Fitch. Personal credit scores and bond credit ratings have a direct impact on the interest that will be paid on any financing; the higher the rating/score leads to lower risk, thus lower interest rates.

Here is a relatable example: For those who recently purchased a home, and had a mortgage prior to 2022, their interest rate made a significant impact on their affordability, and their credit mattered more than ever. For a municipality assuming a $20,000,000 bond issue, a small change of a quarter of a percent is the difference of $305,000 in interest costs. Deviations like this is why the credit rating of government entities is more important today than two years ago when we lived in a 2 percent interest rate world. Since the housing crisis of 2008, finance professionals and elected officials have had the luxury of low rates, and credit worthiness was not a costly factor. We have an entire generation of finance professionals and elected officials who didn’t have to worry about the credit worthiness of their municipal entity.

While the idea of municipal financing, bonds, bond ratings and property tax descriptions and breakdowns might be intimidating, it is important to the pocketbook of local residents and should not be ignored. If you’re interested in learning more about your local city, town or school district as it relates to municipal financing, I would encourage you to contact your local city/town council representative or your local school board members for details. As local elections are in full swing, it is vital to understand the priorities of candidates in terms of financial stability because it truly does impact us as residents. Stay engaged, it matters.

Oscar Gutierrez is president and founder of Bondry Consulting.