Does a positive debt analysis mean it’s time to start building or stay conservative with funds?

By Adam Aasen

In late April, Carmel received good news from Standard & Poor’s Ratings Services.

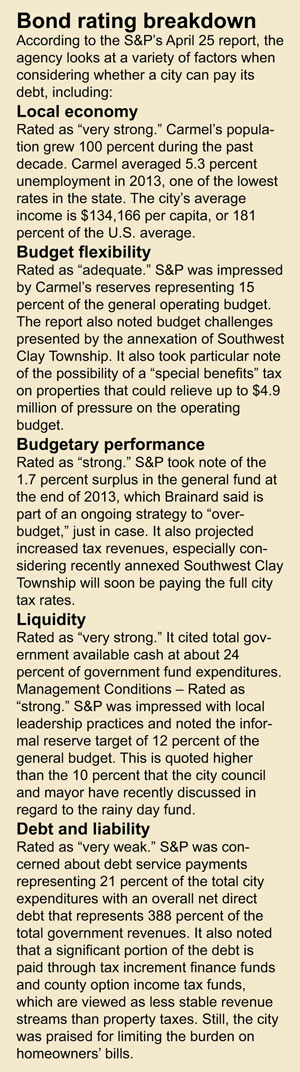

Boosted by a recent debt refinancing, the agency raised the city’s local income tax bond rating from “AA-” to “AA” and reaffirmed the city’s general bond rating at “AA+.”

In plain English, this means the city is viewed as having good credit, which means it receives a lower interest rate when it borrows money using bonds. Everyone from Mayor Jim Brainard to his toughest critics agree that this is good news for Carmel, but some disagree on what it actually measures.

One side seems to think this means there is no financial trouble for the city, which means it’s a good time to start new projects and continue with Brainard’s vision for Carmel. Others seem to think it vindicates the city council and its efforts to rein in government spending ever since the refinancing of the Carmel Redevelopment Commission’s debt when the agency was on the brink of bankruptcy.

And it seemingly comes down to what the interpretation of a bond rating actually measures.

And it seemingly comes down to what the interpretation of a bond rating actually measures.

Investors often look to buy municipal bonds instead of stocks because they are a safe choice. The rate of return is lower, but the risk is lower, too. That’s because bonds are rated by agencies such as Standard & Poor’s (S&P) and Moody’s, so people know how risky they are.

A lower bond rating means the borrower pays a higher interest rate because they are viewed as risky and bond buyers see a higher rate of return.

A bond rating measures whether a city can pay back the bond and it’s not investment advice.

Brainard said the recent S&P bond rating report is “all good news,” especially when people consider how thorough the process is.

He said the city provides figures backed up by documents and speaks with bond rating agents for almost five hours. S&P officials have even done site visits to make sure there are no unfunded infrastructure needs that could cost the city down the road.

Councilor Rick Sharp said he believes the rating vindicates a conservative approach the city council has taken recently, but he warned that a bond rating doesn’t measure everything. In his opinion, he believes these documents can be compiled a certain way to paint a rosy picture.

“The bond ratings have nothing to do with anything but one subject, ‘Can you repay the bond with the revenue you’ve identified?’ Their investigation comes down to a city filling out a form and they could fill out the form a variety of ways,” he said.

Brainard said he believes bond raters want to have a good reputation with investors so they wouldn’t give Carmel a good rating if it didn’t deserve it.

Of course, in 2012 Carmel did receive a downgrade in one of its bond ratings from Moody’s, a company they no longer use. Moody’s dropped the rating because of “volatile fluctuations in county option income tax revenues” among other issues.

Brainard said Moody’s had received incorrect information and failed to notify them prior to the downgrade, which would have given him the chance to correct the misinformation.

Clerk-Treasurer Diana Cordray, who sent the requested information, said she believes everything was accurate.

“I’m sorry but I don’t lie to people,” she said.

The reason the bond rating is important is because it constantly guides decisions made by the mayor and the council.

In public meetings, Councilor Luci Snyder has brought up several times the need to keep a reserve amount equal to ten percent of the general fund because it could affect the bond rating. This has been a point of disagreement between her and the mayor because he feels since liquidity was rated as “very strong” then it is OK to take some money out of the rainy day fund for issues such as roads.

Sharp and Snyder both expressed concern that shortfalls in TIF revenue could mean the city would automatically institute the special benefits tax to make bond payments. Snyder noted that the S&P report seemed to reference that tax as insurance for repayment.

City Councilor Ron Carter said he believes the constant talk about cutting the budget or reducing spending to avoid the special benefits tax is just a “scare tactic by four people on the council” to score political points.

“I’ve been listening to the sky is falling for over ten years,” he said. “For over a decade, people on council have said that taxes would have to be paid. We have never defaulted on payments and we never raised taxes and we really don’t have the prospect of that.”

The mayor said fear about the tax is a “Chicken Little” situation, and he believes under the very worst scenario, such as one where no TIF money was raised at all, that such a tax would only amount to $5 or $10 per person.

“In our case, we could raise our tax rate,” he said. “Taxes have been historically very low.”

Brainard said the positive bond rating is a sign that Carmel is in good shape to continue investing in development. He said the interest rates are so low that it makes sense to issue new bonds currently.

“If I had a city council that really was aggressive and willing to take some reasonable risks then it would make sense to go out, because there is going to be inflation coming up I think … and issue debt now because we can get debt for maybe three percent,” he said.

Of course, in the S&P report it states: “It is our understanding that the city currently has no additional debt plans.” And some on the city council would be opposed to taking on any new debt.

“We have a huge load of debt,” Snyder said. “The mayor is assuming the economy is turning around. I’m saying it is still in difficulty. I understanding the rates are good. That doesn’t mean you borrow every dime that you can.”

But the mayor will continue to make his pitch to the council, especially for the proposed Midtown Redevelopment Plan which would connect Carmel’s City Center and the Carmel Arts & Design District with commercial and residential development surrounding an expanded Monon Trail.

Brainard said the council has been on board with the idea but he doesn’t understand the hesitancy to issue bonds to build a parking garage, which he said is absolutely necessary to achieve the density needed in the area. Otherwise, he said sprawling parking lots could threaten the city’s tax base.

The mayor expressed the importance of the project being a private-public partnership but admitted the private aspect will likely start first. It is possible that developers Pedcor or Justin Moffett’s Old Town Design Group could break ground on their sites, which could help Brainard make his pitch to complete the project. Still, the mayor said he’s willing to be patient.

Cordray, who recently attended a conference where the bond ratings were discussed, said she has been carefully following the city’s debt, which she said could be an issue for bond raters.

“There is this idea that the government has to borrow money to build these projects, but there’s no reason why private companies can’t pay for this themselves,” she said. “I don’t make policy decisions, but I know that having so much debt can be harmful to our bond rating.”