By Mark Ambrogi

Terry Cala wants to help his fellow Baby Boomers prepare for their future.

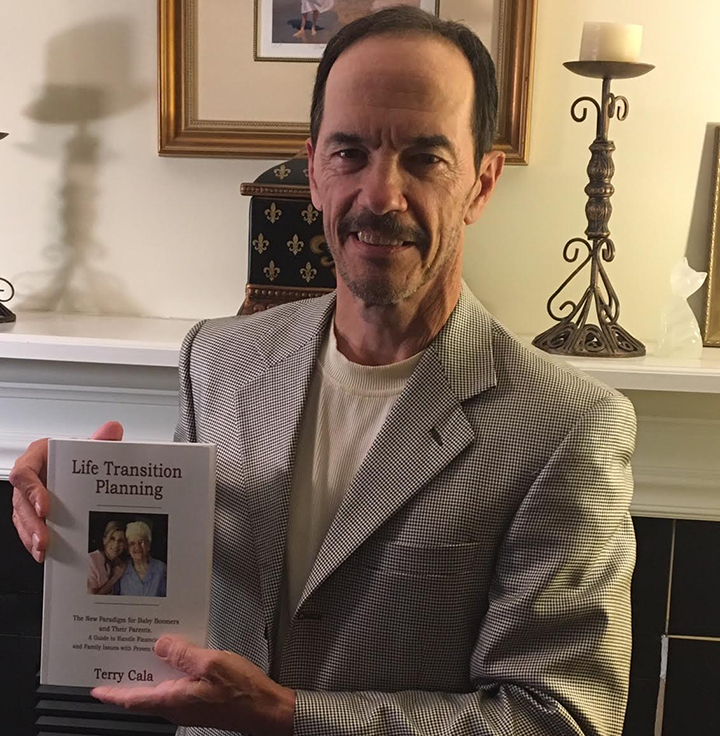

The Fishers resident published “Life Transition Planning: The New Paradigm for Baby Boomers and Their Parents.” Cala said the book is a follow up to his first book, “Money Talks: A Banker Speaks Out on the Great Recession,” published in 2010. Cala said that book explained the origins and reasons for the Great Recession along with the significant legislation that was passed in the following two years after the Recession.

“My new book looks at American life eight years after the Great Recession and is based on observations I have made as a banker over the last 30 years, working in Indianapolis and in Naples, Florida,” Cala said.

Cala, a certified financial planner with his own consulting company, said with nearly 80 million Baby Boomers transitioning into retirement, preparation is key.

“What happened in 1999, 2000 and 2008 was significant downturns in the (stock) market, which affected the Baby Boomers because now many of them are not prepared financially for retirement,” Cala said. “The other part is the estate planning to the point where they are going to need assistance with their daily care, their finances and their personal life.”

Cala, 61, encourages people not to wait so long to prepare for retirement and make their transition plan.

“We look at who is going to be your power of attorney, do you have a last will and testament, do you have end of life directives, a living will and health care power of attorney,” Cala said. “From my research, people are very unprepared in general. We can’t control the economy. What we can control is our own household, our family issues and making sure we’re protecting loved ones as well as ourselves as we are going to into retirement.”

In his view, Cala said the financial situation has not improved

“So, we’re worse off than we were eight years ago,” Cala said. “But we can come out of it. What we need to do is planning. I call it an estate plan on steroids. The estate plan says what is going to happen when I need someone to take care of me and what is going to happen to my assets, my family and my business holdings, what’s going to happen when I (die). What we find is people are not prepared for retirement. Half of the population over 55 has not saved anything for retirement so they don’t have the money. And we’re living longer as we all know.”

Cala’s book is available on Amazon.com.